- Research

- Open access

- Published:

Empirical examination of relationship between venture capital financing and profitability of portfolio companies in Uganda

Journal of Innovation and Entrepreneurship volume 11, Article number: 30 (2022)

Abstract

In recent times, venture capital (VC) financing has evolved as an alternative feasible funding model for young innovative companies. Existing studies focus on whether VC enhances profitability. While helpful, this body of work does not address a critical question: whether VC firms are more profitable than non-VC firms. The co-existence of both VC and non VC firms in Africa provides an opportunity to address this question. Accordingly, this paper sought to extend the understanding of the relationship between VC financing and the profitability of portfolio companies in Uganda, a rapidly growing VC market. We utilised a mixed methods approach, which involved quantitative data collected from 68 key VC stakeholders, and qualitative data collected from 16 semi-structured face-to-face interviews. The results confirm the superior performance of VC-financed enterprises when compared to non-VC-financed enterprises. The study makes a vital contribution by offering a diversified framework for enterprise success. The framework will assist VC firms in evaluating and customising funding programmes that can propel early-stage firms’ success in Uganda, and in similar emerging economies. Secondly, our results contribute to extant knowledge about recent developments in Uganda’s VC industry and how it influences the profitability trends of SMEs, also in similar emerging economies.

Introduction

In recent times, venture capital (VC) financing has evolved as the most feasible funding model for young innovative companies. VC firms provide the needed capital in exchange for equity shares in the portfolio companies (Amornsiripanitch et al., 2019; Gompers & Lerner, 1999, Gompers et al., 2020; Hirukawa & Ueda, 2008; Kato & Tsoka, 2020; KPMG & EAVCA, 2019; Li & Zahra, 2012; SAVCA, 2011). Seen from a different standpoint, the contribution of VC to the profitability of early-stage enterprises has not been extensively deliberated among scholars in developing countries, therefore, inadequate evidence is available to acknowledge its impact on the growth of small firms (Ernst & Young, 2016; Shanthi et al., 2018). In this context, this paper sought to extend the understanding of the role VC in boosting the profitability of portfolio companies in Uganda.

Tykvova (2018) disclosed that the VC finance framework is not a one-size-fits-all framework. Venture capitalists (VCs) select only companies with high growth potential, and consequently, only a few start-up firms qualify for VC investment. While several studies highlight the benefit of VC investment to young companies, the relationship between VC financing and the profitability of the portfolio companies has been under-researched. As a result, a review of previous research offers inadequate conclusions to account for these differences in performance, moreover, many of these studies focused mainly on developed economies.

VC firms and practitioners typically utilise profitability as the principal financial measure to project the success of the portfolio companies (Emerah & Abomeh, 2020). However, some scholars criticise this approach to measuring business performance, because it is restricted to past performance. In addition, it is regarded as an unrealistic technique of treating depreciation and amortisation as part of the company expenses, yet it does not involve direct cash outflows. That said, small and medium-sized enterprises (SMEs) with demonstrated profits find it easy to inspire VC investors that are experienced in financing high-risk entrepreneurial firms. VCs make investments in portfolio companies in which they earn returns of between 20 and 30% from the invested capital (Gompers & Lerner, 1999). Nevertheless, the concept of VC financing has remained misunderstood in Uganda, despite the vital role it can play in the country’s economy.

Although VC has surged globally in the last 20 years, in, for instance, the United States of America (US), Europe, Canada and China, it has largely focused on the technological sectors, with a nominal allotment of funds to the manufacturing and agro-business sectors that form a colossal share of the SME ecosystem, especially in developing economies, such as Uganda (AVCA, 2020; Kato & Tsoka, 2020; SAVCA, 2014). Thus, only a few portfolio companies have the opportunity to be financed by VC investors, hence, widening the financing gap. Likewise, Ekanem et al. (2019) observed that VCs transplanted the Silicon Valley model to emerging markets without making meticulous adjustments to reflect the needs of their business environment. This VC myopia has been identified as hampering SMEs’ growth.

Furthermore, few empirical studies have engaged the mixed technique for data collection, moreover, a significant number of empirical studies were conducted 20 years into the past (Gompers & Lerner, 1999; Lerner, 2010). Prior literature suggests that most of the research assessing the impact of VC on the performance of SMEs essentially engaged business owners/ managers as the key respondents (Biney, 2018; Kwame, 2017). Therefore, the present study is distinct as it focuses on all the key players in the VC market. The research adopted a mixed method approach and presents a current understanding of the impact of VC on the profitability of the portfolio companies in the public domain. Worse still, these studies largely present results from advanced economies, henceforth, widening the literature gap that compels demand for future research in Africa. In addition, Uganda’s VC market is under-explored, with little evidence to explain how VC financing has influenced SMEs’ performance (Kato & Tsoka, 2020; UIA, 2016).

Therefore, we reviewed the current literature to identify existing gaps in our current understanding that may provide a foundation for this study. We also reviewed the successful experiences of the VC landscape from developed economies, and conflicting experiences of duplications globally. The paper was guided by two fundamental research questions:

-

1.

Does venture capital financing spur the profitability growth of the portfolio companies?

-

2.

How does the venture capitalists’ involvement influence the success of the portfolio companies?

This paper makes four major contributions: firstly, the paper highlights the demand for government to enhance VC supply to early-stage firms, as well as to create a favourable investment environment which will inspire foreign VC firms to invest in the country. This may involve government support to reduce the taxes levied on capital gains on the disposal of business assets during initial public offerings (IPOs) or trade sales. Secondly, the results from this study will benefit the VCs in their efforts to make ideal investment decisions to enhance VC market development. Thirdly, the study makes a vital contribution to knowledge by offering a diversified framework for enterprise success in emerging economies. The framework is expected to benefit the key players in the VC market in their efforts to evaluate and customise sufficient funding programmes that can propel the success of early-stage firms. Finally, this paper also extends our knowledge about recent developments in the VC industry and how it influences the profitability trends of SMEs in emerging economies, such as in Uganda.

The rest of the article is divided into five sections. The next section presents the theoretical literature review, while "Empirical literature review and hypotheses development" section discusses the empirical literature review and hypotheses development. "Research design" section describes the research design. Finally, "Empirical results and discussion" section presents the empirical results.

The theoretical literature review

Agency theory demonstrates the nexus between the VCs who are the principals in the VC contract and the business entrepreneurs (agents), delegated to work on behalf of the VCs. The principal–agent relationship (VC contract) is established when the entrepreneurs agree with VCs to invest in the start-up firms in exchange for equity shares (Bertoni et al., 2019; Cumming et al., 2017).

Hα1: The venture capitalists’ involvement in the portfolio companies influences their success

The principal–agent problem postulates interrelated conflicts of interest which could emerge in the execution of the contract. This often arises at the time when VCs exit the company through either trade sale or initial public offerings (IPOs), leading the agents into divergence from the best interests of the principal. However, VCs are aware of such barriers that may have behaviour or outcome-based impediments to their interests. Therefore, VC investors insist on stringent control measures and monitoring aspects to guard their business interests through secure minority seats on SMEs’ board of directors (BOD). They maintain a sound business and add value to portfolio companies to recover worthy return on investment (ROE) shares (Cumming & Johan, 2016). It is well documented that misunderstandings usually emerge at the exit of the VCs, particularly if this is not well managed from the inception stage. There is noticeable principal–agent conflict that emanates from information asymmetries and fear of the business owner losing control over their investments (Amit et al., 1998).

That being said, the VC contract is vital to guard against eventual disputes between the portfolio managers and VCs. The VC financing concept resonates well with the agency theory (Hellmann & Puri, 2002. This certainly requires SMEs to agree with VCs in order to access the financing needed for their growth and expansion, thus, enforcing VC contracts to protect the interests of both parties.

Hα1: Venture capital financing model spurs the profitability growth of the portfolio companies

The principal–agent relationship concept has been proven to stimulate SMEs’ performance in terms of sales revenue profitability, return on equity (ROE) and return on assets (ROA). This theory provides a firm foundation for our research hypothesis. However, imperfections in the market indicate that this assumption is not fully valid. Pragmatic evidence has disclosed that start-up firms seek external financing sources only if their retained earnings are insufficient to meet their business needs (Myers & Majluf, 1984). In addition, some entrepreneurs may not welcome VCs in their business because it compromises their control power, hence they are compelled to depend on retained earnings although they may not sufficient to foster the SME’s growth. Therefore, it is not usually accurate for VCs to assume that the entrepreneur may not abide by the VC contract, and therefore, it may be unnecessary to set the stringent rules in VC contracts. That seemingly appears to be biased, having no consideration for the fears of the entrepreneurs, specifically in the appropriation of profits.

Empirical literature review and hypotheses development

This section delivers a detailed review of the extant literature that underwrites the relationship between VC finance and the profitability of portfolio companies to inform and elucidate our insights. The paper primarily describes the central concepts of VC and the theoretical framework underlying its influence on the performance of VC-financed companies, which provides the foundation for the study.

Venture capital and the profitability growth of portfolio companies

One of the very first studies assessing VC-financed enterprises’ performance, was piloted by the Venture Economics Incorporation for the US General Accounting Office in 1982. The study disclosed that VC-backed companies realised tremendous growth in sales turnover, employment creation, and tax payments, if compared to other companies. In line with the benefits of VC financing, the National Venture Capital Association (NVCA) (2021) discovered that the VC-backed companies grew faster than their national industry counterparts in terms of employment, sales, and wages. Similar results were also obtained in Europe (KPMG & EAVCA, 2019), where venture-backed companies achieved a yearly sales growth of 35%, compared to the 14% of other associated European public firms, and employment grew 30.5%. Therefore, such mixed conclusions necessitate a novel empirical study that would be able to fill these literature gaps.

Several researchers, mainly from technologically advanced economies, have confirmed that VC finance is a reality in augmenting the growth of SMEs (Deloitte & NVCA, 2009; Gompers & Lerner, 1998; Lerner, 2010). VC financing is connected to faster growth in early-stage firms, and that it is a precursor for innovation and the internationalisation of the portfolio companies (Kelly & Hankook, 2013; Mason, 2009; Bruton et al., 2015; Chemmanur et al., 2011). While there are various reasons for starting a commercial enterprise, profit maximisation is the primary objective (Kenawy & Abd-el Ghany, 2012). It is common knowledge that early-stage enterprises certainly need to earn profits to attract patient capital to ensure their continued commercial growth and expansion over time. Albeit VC finance has been extensively studied, its subsequent impact on the profitability of the portfolio companies is comparatively underexplored.

Profitability is a significant pointer to estimate the growth of SMEs, which is also a rising concern for VC investors. Audretsch and Lehmann (2004) and Chahine et al. (2012) discovered that VC-financed firms are highly associated with good profitability and market performance, if compared to non-VC-financed companies. However, some scholars present conflicting results, asserting that VC financing does not necessarily encourage enterprise growth. This is attributable to the selection criteria wherein VC investors identify high-growth potential firms that would probably have grown, even without receiving funding from the VC firms. Similarly, Tykvova (2018) reveals that the primary goal of the VC investors is to reap high returns from the funded companies, and SME growth is a spin-off to their primary purpose.

Furthermore, Puri and Zarutskie (2012), Kelly and Hankook (2013) and Paglia and Harjoto (2014) showed that VC financing positively influences the VC-funded companies’ profitability growth. Jaki et al. (2017) asserted that profitability growth changes progressively in the early stage of 3 to 5 years, and subsequently a decline is recognised when the VCs plan to exit. However, Harris et al., (2014) reported unsatisfactory results in terms of returns on invested capital. This ignited further studies of this kind to accentuate the critical role played by VC in enhancing the profitability of the investee companies.

While most literature paints an intriguing picture of VC investment, the reality is that VC is one of the riskiest investment models. VCs firms lose a third (1/3) on the entire investment, and then expect to get a third (1/3) of nominal investment returns, and expect to generate a third (1/3) on the bulk of the investment returns (Kato & Tsoka, 2020). Since many VCs do not want to expose their failed ventures, there is a lack of relevant data, especially in Africa. Therefore, such mixed conclusions necessitate a novel empirical study that would be able to fill these literature gaps.

Role of venture capitalists on the BOD and enterprise success

Several studies have documented that the VCs’ involvement on the BOD is fundamental for the success and growth of the VC-financed companies (Bertoni & Tykvová, 2015; Gompers et al., 2020; Hellmann & Puri, 2002).

Gompers & Lerner, (1999) and Hellmann and Puri (2002) disclosed that VCs enter into VC contracts with entrepreneurs as a way to deal with the moral hazards and information asymmetries. In addition, VCs bring with them technological transfers, coupled with superior skills in terms of human capital that would otherwise be inaccessible without their buoyant presence on the BOD. Similarly, Lerner (2010) and Gompers et al., (2020) reported VCs do not only provide VC funds, but also secure minority seats on the BOD to oversee their investments, detect financial risks to the companies at an early stage, undoubtedly close the knowledge gaps, and manage volatile markets. These findings conflict with the earlier conclusions of Gompers and Lerner (1998), where they submitted that the VC-backed industries are characterised by a potential conflict of interests that may compel the VCs to grandstand portfolio companies for IPOs or trade sale. This study was extended by Tykvova (2018) who alluded that the VCs aim to reap high returns on their VC investments.

Surprisingly, while several authors praise the VCs for their growing involvement in portfolio companies, Aldrich (2008) and Lee and Wahal (2004) disclosed that VC financing is not aimed at mediocre companies, nor is it designated for all commercial sectors. VC is not a one-size-fits-all framework because it only benefits a small number of the early-stage enterprises whereby, on average, two out 100 potential SME applicants qualify for VC funding (Deloitte & NVCA, 2009). The worst scenario is that VC investors target specific industries, for instance, high-tech industries, and concentrate in a few regions globally. Therefore, VC performance in emerging economies, such as in Uganda, has remained unclear.

In conclusion, prior literature confirms that VC financing stimulates the growth of start-up firms and is a sustainable solution for averting the problem of lack of access to external financing. However, there is little evidence to document VC performance in Uganda.

The literature review offered a firm foundation for crafting the research questions to assist in data collection and analysis. The next section discusses the research design approach.

Research design

Background to venture capital in Uganda

While the VC gauge has been exceptionally skewed to the US which by far is the leader in the VC industry, in the last decade, numerous countries including Uganda, have begun to tap into the possibilities that venture-backed companies can offer. In contrast, Uganda government has remained unclear about suitable policy frameworks to undertake (Kato & Tsoka, 2020), and considerable misapprehensions about this financial intermediary remain a big problem. Uganda’s VC market is under-explored, with little evidence to explain how VC financing has influenced SMEs’ performance (Kato & Tsoka, 2020; UIA, 2016). Against the backdrop of this discourse, we reviewed the existing literature and theoretical concepts to answer the research questions with a focus on Uganda.

Research methods

To obtain a better insight of the nexus between VC financing and profitability of the portfolio companies, we conducted a case study using a mixed method because it provided the author with the opportunity to obtain a more comprehensive understanding of the research problem. The quantitative method was more predominant in this study. Previous researchers have also used the mixed-method research approach (Kato & Tsoka, 2020; Kwame, 2017) and commended it for yielding reliable and valid datasets.

Population, sample size, and data collection

The primary data were collected from the Uganda Investment Authority’s (UIA) database comprising SMEs classified as the top-performing SMEs in 2018 and 2019. Since UIA did not maintain a segregated catalogue for VC-backed firms, we also used the profiles of active VC firms in Uganda to track their portfolio companies. Stratified random sampling was applied to obtain a sample size of 90 respondents from a total population of 300 SMEs. Our sample respondents were selected from the central business districts (CBD) with the highest concentration of SMEs situated in the Kampala, Wakiso, and Mukono and Jinja districts. The manufacturing agribusiness sectors were preferred because they contributed 21.6% and 67% to the total national revenue collections than the fast-moving consumer goods sector (URA, 2018). The key respondents included VC firms responsible for financing SMEs; government agencies in charge of regulating the business environment; business entrepreneurs/managers as the recipients of VC finance; and non-VC-backed firms. This choice aimed to match the performance of the VC-backed firms against the non VC-backed firms.

As it can be seen in Table 1, the VC-funded and non-VC-funded enterprises contributed a higher percentage of 89% combined, because the major aim was to measure the SMEs’ growth in terms of profitability, ROE, ROA, and how government regulations impact the portfolio companies. In addition, VC firms and government agencies were included in the study because they do provide risk capital and determine the direction of the funded companies. This helped to gather reliable data in terms of SMEs’ performance.

Primary data were collected using 5-point Likert scale semi-structured questionnaires that were administered to 90 key respondents. This data collection instrument offered the respondents an opportunity to complete the questions at their convenience, since they comprised a customarily busy class.

The survey questionnaire involved multiple questions ranging from strongly disagree (1) to strongly agree (5) and an average score for agreeing ≥ 3.5. Out of the 90 questionnaires administered, 70 were returned and 2 were found not suitable for data analysis. Consequently, 68 responses from the questionnaires were used for data analysis.

Furthermore, we purposely selected 30 participants (S = 10% of 300) for face-to-face semi-structured interviews.

Table 2 shows a higher composition of SME management staff of 66.7%, followed by a 20% share of VCs/Business Angels. These groups were chosen because they compose the highest decision-making body of SMEs, and possess a wealth of knowledge and are the custodians of the data required for the study.

Measurement of independent and dependent variables

To measure the interdependence between independent variables and the dependent variables, we used a multiple regression model, wherein VC finance and profitability are designated as independent and dependent variables, respectively. We extracted data from the 68 survey questionnaires, this was organised into an Excel worksheet, thereafter exported to the SPSS computer-aided program to run the results. We also computed the sales turnover, ROE, and net income using the ratio analysis with the assistance of the audited and unaudited reports provided by the respondents.

Table 3 shows that out of the 90 questionnaires administered, 68 completed and returned questionnaires were appropriate for data analysis. This produced a response rate of 76%, higher than the comparative study of Memba et al. (2012) which had a response rate of 65%. These results are supported by Mundy (2002), who maintained that the higher the response rate, the better: 60% would be marginal, 70% would be reasonable, 80% would be good, and 90% would be excellent. As such, there is no justification not to accept a response rate of 76%, because it conveys reliable and valid results, and is representative of the entire population under study.

In the regression model yi denotes VC finance and VCs role in POs as the independent variables, then the dependent variables are denoted as \({X}_{1}\)…\({X}_{n}\). To measure profitability, we used the following performance metrics: sales turnover, EBIT and ROE. Government regulations come as an intervening variable.

The multiple linear regression model is illustrated as:

where Y: is % of profitability that is measured as (sales, ROE, ROA, and EBIT); β0: is the y-intercept wherein the value of y when \({X}_{j1}\), \({X}_{j2}\dots {X}_{jk}\) are equal to 0; β1 and β2 are the regression coefficients that represent the change in y relative to a one-unit change in \({X}_{j1}\), \({X}_{j2}\dots {X}_{jk}\), respectively; Βk: is the slope coefficient for each independent variable; \({X}_{1}\): venture capital finance as one of the independent variable; \({X}_{2}\): VCs involvement on the BOD as the second independent variable; ϵj: is the model’s random error (residual) term.

The predictor variables are specified as a j and k matrix.

where J: is the number of observations, and K: is the number of predictor variables.

Each column of X denotes one independent variable, and each row represents one observation, while y is the response for the corresponding row of X.

The null hypothesis is that all of the population regression coefficients are zero. The alternate hypothesis is that at least one of the coefficients is not zero. This test is written in symbolic form for three independent variables as:

-

H0: β1 = β2 = β3 = 0,

-

H1: Not all the β s = 0.

The VC-backed companies and non-VC-backed companies are binary variables that were allocated 1 to indicate they received VC financing, and 0 if they did not receive VC financing.

To confirm the research questionnaire for validity and reliability, Cronbach’s Alpha coefficient was applied to test the results, with a 95% significant confidence level and a 5% margin of error. The results showed a 98.4% confidence level of the survey questionnaire and a margin of error of 1.6% which was much lower than the estimated 5%. The statistical tests relied on the two-sided tests represented as 0.05 level of significance.

The interview data were collected from 16 respondents. This paper is unique in that it conveys the thoughts of the different players in the VC market, something that has not been reported in earlier studies. The recorded interview data, videos, audited accounts, financial reports, narrative reports, and researcher’s observations were transcribed, reviewed, and later exported to Atlas.ti version 25. We generated memos, groups, and networking linkages which facilitated a coherent content analysis of the data. Thereafter, the data were validated and triangulation was performed until a point of saturation was attained after 16 interviews. Saunders et al. (2009) argued that when the point of saturation is attained, the results are adequate as a true representation of the sample.

Ethical considerations

The study received approval from the Research Ethical clearance committee of the University of South Africa (UNISA) in August 2019. We also received prior approval from UIA and USSIA to access their databases. We further obtained prior consent from all the respondents before commencing the study, and they signed informed consent as confirmation for their involvement in the study. We signed Non-Disclosure Agreements (NDA) not to share any information to any third parties without prior management approval. The respondents had the liberty to decline to respond to some of the questions they found disturbing or which they perceived as uncomfortable.

Empirical results and discussion

Hα1: The venture capitalists’ involvement in the portfolio companies influences their success

The capacity of an enterprise to generate sufficient profits defines its financial stability to primarily enlarge the value of invested capital to meet its financial obligation as a going concern. The profitability approach has been extensively used as a popular and dependable approach, if compared to other methods (Myskova & Hajek, 2017; Du & Cai, 2020), since fund managers frequently search for firms that have previously demonstrated growth potential.

Profit analysis of VC-financed and non-VC-financed enterprises

We specifically evaluated the firms’ profitability fluctuations considering the variability in the taxes charged to the varied sectors, and the different accounting principles used. The paper used EBIT for a rational comparison, because the outcomes may be relatively diverse when earning after tax (EAT) is used.

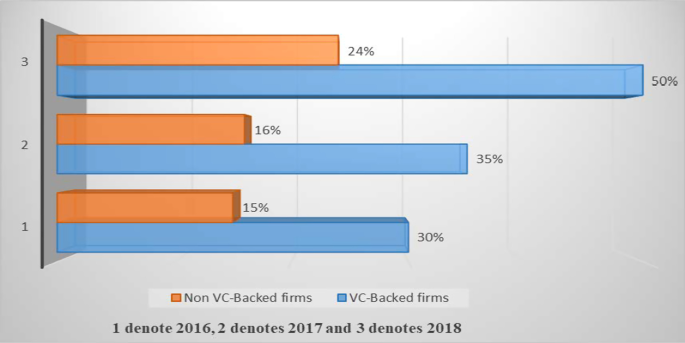

Figure 1 uncovers that the VC-financed companies realised much higher profits of between 30 and 50%, compared to 15% to 24% for the non-VC-financed enterprises. The highest profits were reported in year 3, whereby the VC-backed firms realised 50%, compared to 24% for the non VC-backed firms. In view of these results, the VC-recipient companies doubled the companies financed by other sources. A company that earns higher profits suggests better performance and efficiency compared to the rivals in a similar business sector.

However, the study of Memba et al. (2012) revealed much higher profits of above 60% for the recipient companies. We observe that her study was done over 10 years ago when the presence of the VC firms was still insignificant, suggesting less competition in the VC industry at the time. This potency contributed to reaping high returns in a virgin VC industry. In addition, current research discloses that while there might be other objectives for setting up a company, the major objective is to make reasonable profits. Accordingly, we can confirm that increasing the VC supply to start-ups firms contributes to profitability growth. These results are consistent with prior literature, for instance, Biney (2018), Kato and Tsoka (2020) and Du and Cai (2020).

Considering that the financial statements used for this study from 2016–2018, were prepared based on book value, they do not reflect the current reality in the business and direction of the firm. Consequently, we further ran an ANOVA F-test to assess if the differences in mean values between the VC-backed and non-VC-backed firms are due to chance, or if they are indeed significantly different.

Based on the results from the ANOVA test presented in Table 4, the F-value (3, 2.145) = 5.536 and a significant value of 0.02, which is much less than the 5% level of significance for the regression. This offers irresistible evidence that our model is well fit and valid. The outcomes from the ANOVA test confirm that there is a positive significant relationship between profitability as a dependent variable, and VC finance as a predictor variable. As can be seen, the results confirm that VC financing escalates profitability for the funded companies because the regression coefficient is not equal to zero. In contrast, our findings conflict with the study of Rosenbusch et al. (2013), who found that VC finance does not enhance the profitability of the funded firms.

These results were augmented with 16 face-to-face interviews conducted with the key players in the VC market who generally revealed attractive results. More compelling results were obtained from the VC fund managers. ‘To maximise profits it is mostly about structuring not having a routine or monthly payments, this is the real framework that enhances profitability, DRS05’. The profitability growth of the funded companies shows that about 50% of the projects are doing very well, 30% are struggling, and 30% of the projects are completely failing to grow. They endorsed VC financing for its contribution to the growth of the funded firms.

Although previous studies have painted an intriguing picture of the success of all the VC-backed firms, The Kauffman Foundation (2017) uncovered that 62% of portfolio companies failed to exceed returns from the stock markets. That explains why the number of VC funds has shrunk by 30% in the past decade, according to NVCA (2020). Above and beyond, the current research of Seth (2020) reported that 65% of investment rounds fail to return 1× capital and only 4% return greater than 10× capital. Ultimately, the difference between the best performing and average performing firms are incredibly wide. Comparatively limited investments in the portfolios of VC funds harvest huge gains.

However, we discovered that principal–agent relationship was more predominant in the VC-industry setting and everyday life due to the potential problems of adverse selection and moral hazard. The VCs enter into VC contracts to defend their interests wherein entrepreneurial work as their agents. Our findings revealed that 100% of the respondents confirmed signing VC contracts and allowing at least one VC fund manager on their board structures. Certainly such arrangement brings in play the agency theory to mitigate the moral hazards and information asymmetry related to early-stage enterprises.

All in all, early-stage firms that can demonstrate the capacity to generate worthy profits have higher chances of attracting VC financing because this is the area of interest for any prospective investors. Fund managers primarily depend on profitability ratios to determine the financial health of a firm (Myskova & Hajek, 2017).

Pearson correlation coefficient test

The paper employed the Pearson correlation coefficient tests to determine if there is any relationship between ROA and VC financing. The higher the ROA number, the better, because the company is earning more money on less investment.

As shown in Table 5, the test results display a correlation coefficient of (r = 0.336, P ≤ 0.05) designating that there is a positive relationship, as P ≤ 0.05. It can therefore be concluded that 33.6% (0.336) of changes in ROA can be explained by the use of VC finance. Particularly, firms that received VC financing recognised higher ROA than their non-VC-financed enterprises. Kwame (2017) concurs with these results. A higher percentage of ROA depicts sound financial health of an enterprise represented by its asset base’s capacity to produce profits with each dollar invested. Similarly, a dwindling ROA might indicate over-investment in the assets, or evidence of some of the assets not being productive in supporting revenue growth, which is an indicator of a failing business (Bloomsbury, 2009). ROA is not a flawless metric for measuring a company’s performance, nonetheless it has been observed to be the most effective, since it captures the fundamentals of business performance in a holistic way. ROA captures how well a company uses its assets to create value, and this is a fundamental area of interest to the VC investors.

Hα2: The venture capitalists’ involvement in the portfolio companies influences their success

To satisfactorily identify the impact of VC on the portfolio companies, we also ran descriptive statistics involving mean scores, standard deviation and skewness scores, to illustrate statistically the role of the VC fund managers on the BOD of the portfolio companies.

As seen in Table 6, the descriptive statistics show a mean score of 4.0, and with a standard deviation of 0.7754, suggesting that changes in ROE for the portfolio companies was influenced by VC funding. Precisely 80% (54 of 68) of the respondents confirmed that the growth of ROE was escalated by VC financing. Similar results were reported from the structured face-to-face interviews, wherein all the interviewees (100%) admitted to recognising growth of their firms due to the consulted efforts from the VC fund managers. We can therefore conclude that it is not enough to issue VC finance but the VC’s presence on the board of portfolio companies is fundamental for their success. In addition, we also discovered that 87% (59 of 68) of the respondents lacked adequate knowledge about VC financing. This partly explains why the VC industry in Uganda has remained small. Our findings are consistent with contemporary literature, supporting VC for yielding higher returns.

Moreover, 69% of the interviewees confirmed enhanced growth of their companies arising from the superior skills of the VCs. This was manifested in access to new markets, financial management skills, innovations, and expanding their networks to other potential investors. Consistent with above results, ‘the rigorous due diligence alone is enough to encourage the growth of the business even if VCs do not provide patient capital, respondent DRS05 reported’; whereas, respondent DRS09 observed that the VCs involvement on the BOD assisted to quickly discover the financial hurdles at an early-stage hence mitigating against financial risks. Our findings conforms to earlier scholars who contended that value addition to the portfolio companies is essential for VC investment because it differentiates it from other sources of funds (Hellmann & Puri, 2002; Lerner, 2010).

We also surveyed the interviewees to determine whether there was evolution in ROE of the VC-backed firms after VC financing. The outcomes exposed 25–35% average increase in returns. ‘We are not only there to bring the cash on the table, but we also bring bigger networks to talents to help these companies grow, we bring experience from other markets in terms of how we scale businesses, One of the fund managers DRS06 emphasised’. The results were similar to the findings of Lerner (2010).

Regardless of the appealing results, VCs encounter problems which may undermine the success and growth of the early stage firms. ‘One channel of exiting is when we come out of the business and we are ready to sell our stake, either to the business owners or to the equity market where there is an opportunity to list on the stock market, for which there has not been a great channel, respondent DRS06 stated’. The point to make here is that VCs find it difficult to exit due to the undeveloped financial market in Uganda. In addition, we discovered the presence of VC myopia as the entrepreneurs fear losing control of their companies, arising from the temporal sharing of ownership. This partially explains the gradual uptake of VC investment in Uganda. Therefore, some business entrepreneurs remain sceptical of entering into VC deals because they do not know their destiny. Similar conclusions were presented by Tykvova (2018).

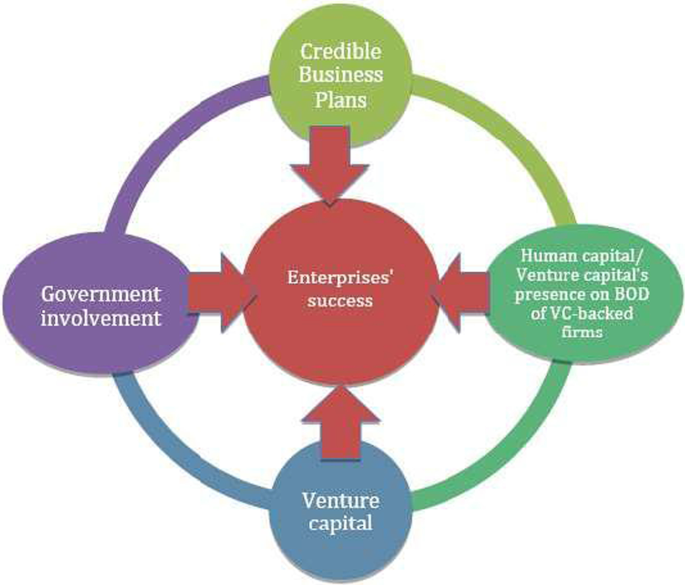

As we continue filling in the gaps in literature, this paper makes a vital contribution to novel knowledge by offering a diversified framework for enterprise success (Fig. 2). This framework will benefit the key players in the VC market to manipulate VC financing to enhance enterprise success. Although VC has been extensively studied, no study has developed a diversified framework for enterprise success that integrates exclusive performance variables like VC finance, government involvement, human capital and credible business plans to assess enterprise success. Our findings reveal that these variables significantly impact enterprise success, and this motivated the authors to develop a framework of this nature to account for these variables which have not been yet used in prior literature.

Accordingly, the interaction of these variables proved indispensable in enhancing enterprise success. Firstly, government involvement in the VC market is essential for making supportive regulations and enhancing co-investment funds into private equity firms. Secondly, VC finance was identified as a significant variable for stimulating enterprise success matched to conventional bank lending. Thirdly, credible business plans for potential entrepreneurs is a turning point for SME success. These performance variables are supported by evidence from semi-structured interviews that disclosed that only 2% of business plans pass the due diligence process to qualify for VC financing. Finally, human capital, encompassing VCs on the BOD and senior management, were identified as instrumental variables in encouraging the enterprises’ success.

This framework is reinforced with our empirical evidence from the quantitative results and interview results (Sects. 5.1 and 5.2). Therefore, the interaction of all these variables as illustrated in Fig. 2, translates into enterprise success manifested in improved profitability, ROE, ROA and sales turnover. To the best of our knowledge, no previous study has ever applied this set of integrated variables to examine the performance of SMEs. On this basis, this framework was necessary to contribute to the body of knowledge and also pave a way for future investigation.

To improve the framework, the study suggests future research to investigate:

‘To what extent does government’s involvement in VC financing, the entrepreneurs’ credible business plans and the presence of the venture capitalists on the BOD enhance early-stage enterprise success in Uganda?’

Conclusion

The study examined the nexus between venture capital finance and profitability of the portfolio companies. The results confirm the superior performance of VC-financed enterprises when compared to non-VC-financed enterprises. Moreover, 63% of the respondents reported a positive impact of government regulations on the development of early-stage firms. We also discovered that only 50% of the VC-backed companies were exceedingly operating as expected, while 30% were struggling and 20% completely failed. Our findings were consistent with results of NVCA (2020). On this basis, increasing VC investment in Uganda and similar emerging economies would assist to close the financing gap which inhibits the success and growth of SMEs.

Furthermore, this paper makes four major contribution; Firstly, the paper highlights the demand for government to enhance VC supply to early-stage firms, as well as to create a favourable investment environment which will inspire foreign VC firms to invest in the country. This may involve government support to reduce the taxes levied on capital gains on the disposal of business assets during initial public offerings (IPOs) or trade sales. Secondly, the results from this study will benefit the VCs in their efforts to make ideal investment decisions to enhance VC market development. Thirdly, the study makes a vital contribution to knowledge by offering a diversified framework for enterprise success in emerging economies. The framework is expected to benefit the key players in the VC market in their efforts to evaluate and customise sufficient funding programmes that can propel the success of early-stage firms. Finally, this paper also extends our knowledge about recent developments in the VC industry and how it influences the profitability trends of SMEs in emerging economies, such as in Uganda.

However, this study encountered some drawback which may not be overlooked. The study was confined to agribusiness and manufacturing SMEs largely in the four major cities of Uganda. Therefore, the results ought to be used with caution as they may yield subjective results in the different sectors, like Fintech industries and generally, the service sector. Although VC financing appears exciting and is widely accepted to spur enterprise success and growth, only a handful of studies have examined the impact of VC financing on enterprise success. Therefore, future investigations in this area would complement this study and improve the diversified framework for enterprise success.

Availability of data and materials

The datasets generated and/or analysed during the current study are not publicly available due to the Non-Disclosure agreements we signed with the respondents, but are available from the corresponding author on reasonable request.

References

Aldrich, H. E. (2008). Research Communications. Chapel Hill, NC: University of North Carolina.

Amit, R., Brander, J., & Zott, C. (1998). Why do venture capital firms exist? Theory and Canadian evidence. Journal of Business Venturing, 13, 441–466.

Amornsiripanitch, N., Gompers, P., & Xuan, Y. (2019). More than money: Venture capitalists on boards. The Journal of Law, Economics, and Organization, 35(3), 513–543.

Audretsch, D. B., & Lehmann, E. (2004). Financing high-tech growth: The role of banks and venture capitalists. Schmalenbach Business Review, 56(4), 340–357.

AVCA. (2020). Venture capital in Africa: Mapping Africa’s start-up investment landscape. Retrieved from https://www.avca-africa.org/media/2603/01746-avca-venture-capital-report_4.pdf.

Bertoni, F., Colombo, M. G., & Quas, A. (2019). The patterns of venture capital investment in Europe. Small Business Economics, 45(3), 543–560.

Bertoni, F., & Tykvová, T. (2015). Does governmental venture capital spur invention and innovation? Evidence from young European biotech companies. Research Policy, 44(4), 925–935.

Biney, C. (2018). The impact of venture capital financing on SMEs’ growth and development in Ghana. Business Economics Journal, 9, 370.

Bloomsbury. (2009). Finance - The ultimate resource. https://www.bloomsbury.com/uk/qfinance-9781849300025/. Accessed 25 April 2020.

Bruton, G., Khavul, S., Siegel, D., & Wright, M. (2015). New financial alternatives in seeding; Microfinance, crowdfunding, and peer-to-peer innovations. Entrepreneurship Theory and Practice, 131(1), 9–26.

Chahine, S., Arthurs, D., Filatotchev, I., & Hoskisson, R. (2012). The effects of venture capital syndicate diversity on earnings management and performance of IPOs in the US and UK. An institutional perspective. Journal of Corporate Finance, 18(1), 179–192.

Chemmanur, T. J., Krishnan, K., & Nandi, D. K. (2011). How does venture capital financing improve efficiency in private firms? A look beneath the surface. Review of Financial Studies, 24(12), 4037–4090.

Cumming, D., & Johan, S. (2016). Venture’s economic impact in Australia. Journal of Technology Transfer, 41(1), 25–59.

Cumming, D. J., Grilli, L., & Murtinu, S. (2017). Governmental and independent venture capital investments in Europe. A firm-level performance analysis. Journal of Corporate Finance, 42(1), 439–459.

Deloitte., & SAVCA. (2009). The calm after the storm? The South African private equity confidence survey. Retrieved from http://www.savca.co.za/wp-content/uploads/2013/08/PECSstorm.pdf.

Du, J., & Cai, Z. (2020). The impact of venture capital on the growth of small- and medium-sized enterprises in agriculture. Journal of Chemistry. https://doi.org/10.1155/2020/2328171

Ekanem, I., Owen, R., & Cardoso, A. (2019). The influence of institutional environment on venture capital development in emerging economies: The example of Nigeria. Strategic Change, 28(1), 95–107.

Emerah, A., & Abomeh, S. (2020). Venture capital and performance of small and medium scale enterprises in Nigeria. Journal of Management Sciences, 4(2), 77–87.

Ernst., & Young. (2016). Back to reality, EY global venture capital trends 2015. Retrieved from www.ey.com/Publication/vwLUAssets/ey-global-venture-capital-trends2015/EY-globalventure-capital-trends-2015.pdf

Gompers, P., Gornall, W., Kaplan, S., & Strebulaev, A. (2020). How do venture capitalists make decisions? Journal of Financial Economics, 135, 169–190.

Gompers, P., Lerner, J. (1998). What drives venture capital fundraising? Brookings papers on economic activity, Microeconomics. Washington, D.C.: Brookings Institution

Gompers, P., & Lerner, J. (1999). The venture capital cycle. MIT Press.

Harris, R. S., Jenkinson, T., & Kaplan, S. N. (2014). Private equity performance: What do we know? The Journal of Finance, 69(5), 1851–1882.

Hellmann, T., & Puri, M. (2002). Venture capital and the professionalization of startup firms: Empirical evidence. The Journal of Finance, 57(1), 169–197.

Hirukawa, M., Ueda, M. (2008). Venture capital and industrial innovation. CEPR Discussion Paper 7089.

Jaki, E., Molnar, E. M., & György, W. (2017). Government sponsored venture capital: Blessing or curse? Management, 12(4), 317–331. https://doi.org/10.26493/1854-4231.12.317-331

Kato, A. I., & Tsoka, G. E. (2020). Impact of venture capital financing on small- and medium-sized enterprises’ performance in Uganda. The Southern African Journal of Entrepreneurship and Small Business Management, 12(1), a320.

Kelly, R., Hankook, K. (2013). Venture capital as a catalyst for high growth. Ottawa: Industry Canada. Retrieved from http://www.ic.gc.ca/eic/site/eas-aes.nsf/eng/h_ra02218.html.

Kenawy, E. M., & Abd-el Ghany, M. F. (2012). The economic importance of venture capital as a new funding alternative with reference to the Egyptian experience. Journal of Basic Applied Scientific Research, 2(4), 3598–3606.

KPMG., & EAVCA. (2019). Private equity sector survey of East Africa for the period 2017 to 2018, Nairobi Kenya.

KPMG., & SAVCA. (2014). Venture capital and private equity industry performance survey of South Africa covering the 2013 calendar year. Retrieved from https://savca.co.za/wp-content/uploads/2014/06/KPMG-SAVCA-Private-equity-survey-2014.pdf.

Kwame, E. B. (2017). Assessing the Impact of Venture Capital Financing on Growth of SMEs. Texila International Journal of Management 3(2).

Lee, P. M., & Wahal, S. (2004). Grandstanding, certification and the under-pricing of venture capital backed IPOs. Journal of Financial Economics, 73, 375–407.

Lerner, J. (2010). The future of public efforts to boost entrepreneurship and venture capital. Small Business Economics, 35(3), 255–264.

Li, Y., & Zahra, S. (2012). Formal institutions, culture, and venture capital activity: A cross-country analysis. Journal of Business Venture, 27, 95–111.

Mason, C. M. (2009). Public policy support for the informal venture capital market in Europe. A critical review. International Small Business Journal, 27, 536–556.

Memba, S. F., Gakure, W. R., & Karanja, K. (2012). Venture capital (VC): It’s impact on growth of small and medium enterprises in Kenya. International Journal of Business and Social Science, 3(6), 32–38.

Mundy, D. (2002). A question of response rate. Science Editor, 25(1), 25–26.

Myers, S. T., & Majluf, T. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187–221.

Myskova, R., & Hajek, P. (2017). Comprehensive assessment of firm financial performance using financial ratios and linguistic analysis of annual reports. Journal of International Studies, 10(4), 96–108. https://doi.org/10.14254/2071-8330.2017/10-4/7

NVCA (National Venture Capital Association). (2020). NVCA 2020 yearbook. Retrieved from https://nvca.org/wp-content/uploads/2020/03/NVCA-2020-Yearbook.pdf.

NVCA. (2021). yearbook. https://nvca.org/wp-content/uploads/2021/08/NVCA-2021-Yearbook.pdf

Paglia, J. K., & Harjoto, M. A. (2014). The effects of private equity and venture capital on sales andemployment growth in small and medium-sized businesses. Journal of Banking Finance, 47, 177–197. https://doi.org/10.1016/j.jbankfin.2014.06.023.

Puri, M., & Zarutskie, R. (2012). On the lifecycle dynamics of venture capital and non-venture capital financed firms. Journal of Finance, 67(6), 2247–2293.

Rosenbusch, N., Brinckmann, J., & Müller, V. (2013). Does acquiring venture capital pay off for the funded firms? A meta-analysis on the relationship between venture capital investment and funded firm financial performance. Journal of Business Venturing, 28(3), 335–353.

Saunders, M., Lewis, P., & Thornhill, A. (2009). Research methods for business students (5th ed.). Pearson Hall Limited.

Seth. L. (2020). Venture capital returns are more skewed than people realize. Retrieved from https://timesofe.com/vc-fund-returns-are-more-skewed-than-you-think

Shanthi, D., McGinnis, P., Schneider, S. (2018). Survey of the Kenyan private equity and venture capital landscape. Policy Research Working Paper 8598. New York: World Bank Group.

SVCA. (2011). Private equity in the shadow of giants. Innovative approaches along the investment value chain in Sub Saharan Africa. SAVCA.

Tykvova, T. (2018). Venture capital and private equity financing: An overview of recent literature and an agenda for future research. Journal of Business Economics, 88(9), 325–362.

UIA-Uganda Investment Authority. (2016). Second private equity and venture capital conference 2016, Kampala Serena 24th–25th June 2015. Retrieved from https://www.ugandainvest.go.ug/wp-content/uploads/2016/04/PEVC.

URA-Uganda Revenue Authority. (2018). Revenue Performance report FY 2017/18/16th July 2018. URA’ ‘Kampala. https://www.ura.go.ug/resources/webuploads/GNRART/Annual%20Revenue%20Report_2017_18.pdf.

Acknowledgements

Special thanks to the college of Economic and Managements for the financial support. We further extend our sincere gratitude to the handling editors and two anonymous reviewers whose intuitive remarks made this article superior.

Funding

This study did not receive any funding.

Author information

Authors and Affiliations

Contributions

AIK is the focal author of this article and CPEG is a co-author, who contributed technically as an advisor toward improving the article.

Authors’ information

Ahmed I. Kato is a Postdoctoral Research Fellow in the Department of Applied Management, University of South Africa, Pretoria. Ahmed has published several articles in accredited journals with special focus on venture capital, entrepreneurship and SME development. Moreover, he holds over 14 year’s vast experience in financial management and strengthening research capacity in the NGO sector.

Prof Chiloane-Phetla GE is a Professor of Entrepreneurship in Department of Applied Management, University of South Africa-Pretoria. Prof Chiloane has served in different academic position through her entire career and she has published several articles in accredited journals, written books and presented several papers in international conferences.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Kato, A.I., Germinah, CP.E. Empirical examination of relationship between venture capital financing and profitability of portfolio companies in Uganda. J Innov Entrep 11, 30 (2022). https://doi.org/10.1186/s13731-022-00216-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s13731-022-00216-5

Keywords

- Venture capital

- Profitability and small and medium enterprises

- Diversified-framework for enterprise success

- Uganda